Unlock Potential Saving with a Mortgage Review

Sign up today and enter a monthly draw for a $500 gift card!

That's not all! Let us secure your mortgage by Christmas, and we'll cover your first biweekly mortgage payment*

Sign Up for a Free Mortgage Review & Unlock Exclusive Rewards!

SIGN UP TODAY, ATTEND THE REVIEW MEETING & ENTER OUR MONTHLY DRAW FOR A $500 GIFT CARD!

WE SECURE YOUR MORTGAGE BEFORE CHRISTMAS & YOUR FIRST BIWEEKLY MORTGAGE PAYMENT IS ON US*!

Renew, Refinance,

Restructure with Confidence.

Your free mortgage review may even help you reduce your mortgage payments.

IS YOUR MORTGAGE READY FOR A REFRESH?

SIGN UP TODAY AND ENTER OUR MONTHLY DRAW FOR A $500 GIFT CARD!

BUT THAT'S NOT ALL! WHEN WE SECURE A MORTGAGE FOR YOU, WE'LL COVER YOUR FIRST BIWEEKLY MORTGAGE PAYMENT*!

Real Estate Consulting Service

Quality Is What We Pursue, We Know What We Do

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla sit amet arcu lacinia, elementum

YOU'RE ALWAYS A WINNER WITH BNQ FINANCIAL

Here's how. . .

A free mortgage review can help you discover ways to reduce your mortgage payments or pay off your mortgage faster.

Sign up for a mortgage review today and enter our draw for a $500 gift card. A new winner will be announced each month.

Let us help you with your mortgage financing before the end of the month, and we'll cover your first mortgage payment.

Limited time offer. Terms and conditions apply.

First bi-weekly payment covered for a loan amount minimum of $500,000, capped at $2,000.

Are you sure your current lender is offering you the best solution?

Or maybe you're thinking about refinancing or pulling equity out some of your home's equity.

Did you know you can reduce your payment regardless of the rate?

With rates dropping and the financial landscape constantly shifting, a mortgage review could be the game-changer you need.

WHY REVISIT YOUR MORTGAGE?

UNCOVER POTENTIAL

SAVINGS

Gain a clear picture of the potential savings through our innovative solutions and diverse products that help you lower your monthly payments!

REFINANCE WITHOUT GUESSWORK

Not sure if refinancing is worth it due to exit penalties? Find out if the benefits outweigh the costs, giving you clear data to decide.

STRATEGICALLY CONSOLIDATE DEBT AND BOOST CASH FLOW

See how Consolidating high-interest debt into your mortgage can free up cash flow, simplify finances, and lower interest.

WHY CHOOSE OUR FREE MORTGAGE REVIEW?

ANALYZE PAST DECISIONS

Our review provides an in-depth look at the financial impact of past payments and interest, so you can understand how your mortgage has served you up until now. Even if it hasn’t been ideal, there’s value in learning from the past to guide future choices.

PROVIDE CLEAR FUTURE INSIGHTS

We’ll share transparent, data-driven future scenarios, tailored to your unique goals, so you can see exactly where your decisions might lead. This helps you make an informed, confident choice for the years ahead whether it’s lowering your payment or paying your mortgage faster

SIMPLIFY REFINANCING & DEBT CONSOLIDATION OPTIONS

Based on your financial situation, we’ll recommend the best mortgage options, complete with easy-to-understand comparisons of alternatives. Whether you're aiming to refinance, consolidate debt, or withdraw equity, we make it as seamless as possible with minimal paperwork and a clear, visual comparison report.

Are you certain that sticking with your current lender is the best financial choice?

Or maybe you're thinking of about refinancing or pulling equity out some of your home's equity.

With rates dropping and the financial landscape constantly shifting, a mortgage review could be the game-changer you need.

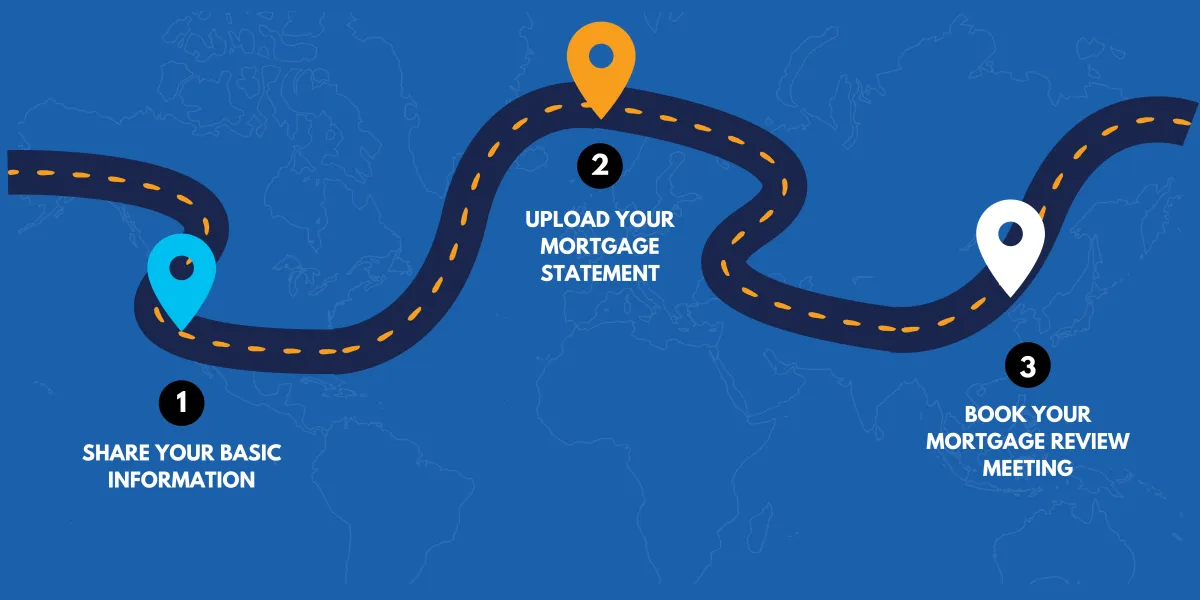

GET STARTED IN 3 SIMPLE STEPS

Signing up for your free mortgage review is simple and only takes a few minutes. All we need from you is:

Signing up for your free Mortgage Review guarantees your entry for a monthly $500 gift card draw.

BE EMPOWERED TO MAKE SMARTER, INFORMED DECISIONS

Take the guesswork out of renewing, refinancing, or restructuring. With our free mortgage review, you’ll be empowered to make smarter, informed decisions. Don’t just go through the motions with your mortgage—take control and see what possibilities lie ahead.

Your free mortgage review is one click away. No string attached!

You're a winner in all cases.

Choose Your Package

Accounting Services That Work for You.

Si ornare porta libero risus ultrices laoreet lorem elit scelerisque. Mollis letius eleifend vivamus consectetur ornare. Praesent interdum torquent laoreet neque posuere tristique amet sapien dui porttitor.

Start Up

Basic Package Service

$ XXX

Monthly

Up to 10 Consultations

Access to cloud service

Access Base Knowledge

Email Support

Small Business

Pro Package Service

$ XXX

Monthly

Up to 10 Consultations

Access to cloud service

Access Base Knowledge

Email Support

Enterprise Business

Enterprise Package Service

$ XXX

Monthly

Up to 10 Consultations

Access to cloud service

Access Base Knowledge

Email Support

Frequently Asked Questions.

Can I benefit from a mortgage review even if I am not close to my renewal date?

Yes, reviewing your mortgage ahead of time can help you plan for potential refinancing opportunities or assess strategies that could benefit you financially.

Is there any cost or obligation with the free mortgage review?

No, the mortgage review is completely free with no obligation to proceed with any services afterward.

Will checking my mortgage options impact my credit score?

No, the initial mortgage review does not affect your credit score. We only conduct a soft review based on the information you provide.

What are the benefits of refinancing my mortgage?

Refinancing can lead to lower interest rates, reduced monthly payments, or the ability to access home equity for other financial needs. However, it's important to weigh these benefits against potential exit penalties.

How does debt consolidation work within a mortgage review?

A mortgage review can help determine if consolidating high-interest debts into your mortgage is a good option. This could simplify payments and potentially lower your overall interest rate.

What does it mean to “capture potential savings” on my mortgage?

Capturing potential savings means identifying ways to reduce your mortgage interest rate or payment amount, which could save you money over the life of your loan.

What happens after I sign up for a free mortgage review?

Once you sign up, we will analyze your mortgage details and send you a personalized report outlining potential savings, refinancing options, and debt consolidation strategies

What exclusive benefits do I receive by signing up?

By signing up, you are entered into a monthly draw for a $500 gift card and may qualify to have your first biweekly mortgage payment covered if we secure a mortgage for you (terms and conditions apply).

Can I trust the accuracy of the recommendations?

Yes, our mortgage experts provide data-driven insights and clear comparisons tailored to your unique situation, so you can make informed decisions with confidence.

What if I decide not to make any changes after my review?

That’s perfectly fine. Our goal is to empower you with the information needed to make the best decision for your circumstances. There is no obligation to act after receiving your review.

How do I sign up for the free mortgage review?

Signing up is simple! Just provide your basic contact information and upload your current mortgage statement or enter the details manually on our sign-up page.

What are the terms and conditions for the $500 gift card and biweekly payment coverage?

Specific terms and conditions apply to the promotions, including eligibility criteria and limitations on biweekly payment coverage. Full details are provided during the sign-up process.

** First bi-weekly payment covered for a loan amount minimum of $500,000, capped at $2,000.

Get In Touch

Email: [email protected]

Address

Office: Lorem Ipsum, XX, 12345

Assistance Hours

Mon – Sat 9:00am – 8:00pm

Sunday – CLOSED

Phone Number:

xxx-xxx-xxxx

Office: 1670 North Service Rd E, Oakville, ON L6H 7G3 Canada

www.bnqfinancial.com

Copyright 2024 . All rights reserved